In the lead-up to NFL Sunday, the sports betting world runs ablaze with talks about NFL public betting splits. Terms like “fade the public” and “follow the money” permeate the airwaves, and public betting stats are plastered across innumerable websites and social media pages. Often, they’re even provided by the sportsbooks themselves.

When it comes to statistics, public betting splits are the belle of the ball. In turn, many bettors are influenced to let them guide their decisions when they bet on the NFL online.

So what exactly is NFL public betting, and it is a useful metric for finding value? On this page, we’ll answer those questions and more, and address the most common misconceptions about betting with or against the masses.

Fade The Public and Claim A Bonus

$1500 In Bonus BetsBetMGM Bonus Code: BUSABONUS

Gambling problem? Call 1-800-GAMBLER (available in the US). Call 877-8-HOPENY or text HOPENY (467369) (NY). Call 1-800-327-5050 (MA). 21+ only. Please gamble responsibly. Call 1-800-NEXT-STEP (AZ), 1-800-BETS-OFF (IA), 1-800- 981-0023 (PR). First bet offer for new customers only. Subject to eligibility requirements. Bonus bets are non-withdrawable. In partnership with Kansas Crossing Casino and Hotel. See BetMGM.com for terms. US $1500 promotional offer not available in New York, Nevada, Ontario, or Puerto Rico.

$1500 In Bonus BetsBetMGM Bonus Code: BUSABONUS

Gambling problem? Call 1-800-GAMBLER (available in the US). Call 877-8-HOPENY or text HOPENY (467369) (NY). Call 1-800-327-5050 (MA). 21+ only. Please gamble responsibly. Call 1-800-NEXT-STEP (AZ), 1-800-BETS-OFF (IA), 1-800- 981-0023 (PR). First bet offer for new customers only. Subject to eligibility requirements. Bonus bets are non-withdrawable. In partnership with Kansas Crossing Casino and Hotel. See BetMGM.com for terms. US $1500 promotional offer not available in New York, Nevada, Ontario, or Puerto Rico.

What is NFL Public Betting?

Public betting in the NFL, and across all major sports for that matter, is a simple statistic that shows the percentage (%) of bets coming in on each side.

For example, if the New York Giants are playing the New England Patriots and 80% of tickets written are on the Giants against the spread, then public betting trends greatly favor the Giants. It’s as simple as that.

In the past, public betting stats were largely inaccurate or only comprised a small subset of the bigger picture. However, legal online sportsbooks in the US have grown extremely efficient at record keeping. If a sportsbook posts public betting trends on social media, or in a daily newsletter, bettors can assume they’re fairly accurate.

Some sports media sites aggregate public betting data from a variety of sportsbooks. These stats are clearly even more accurate because they’re taken from a much larger sample size.

Expert Tip: Just because a stat is accurate doesn’t mean it’s informative.

Public betting talk revolves around three NFL wagers: point spreads, totals, and to a lesser degree, moneylines. Therein exposes the first problem with relying on public betting stats, as they target the three most efficient wagers in football, and arguably in all of sports betting.

What Are Public Money Percentages?

Public money is a statistic that shows the percentage of money, or handle, coming in on a side. As an example, if a sportsbook takes $5m in handle on the Kansas Chiefs vs. Buffalo Bills point spread, and $3.5m is wagered on the Chiefs, 70% of the public money is on the Chiefs.

In the case of public money, the number of tickets written on each side is irrelevant. Only monetary amounts are tracked.

There’s a misconception that including the word “public” means the statistic only accounts for casual, or “square”, bettors. This is not true. Public betting and public money statistics encompass everyone that’s bet into a line leading up to an NFL game.

Public money is generally tracked for the same basic NFL wagers as public bets: point spreads, totals, and moneylines.

What Are NFL Betting Splits?

NFL betting splits are simply a combination of public betting and money percentages. Together, these two variables paint a more telling picture of how bettors are approaching a line, at least in theory.

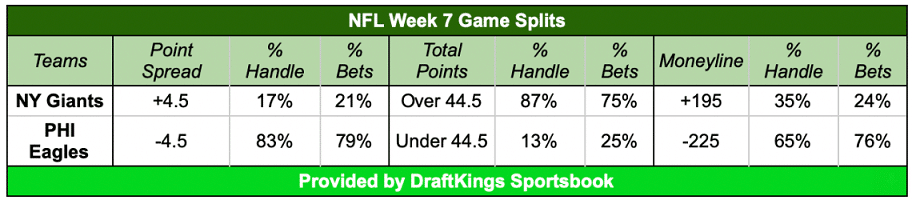

This is what a betting split for an NFL game typically looks like:

There are a few items of note. First, notice that the betting splits were provided directly from DraftKings Sportsbook. This ensures their accuracy, as DraftKings is one of the largest US online sports betting providers.

These splits were posted a full day before kickoff, which should set off an alarm bell. It’s not to say DraftKings is telling bettors how to wager, as that isn’t the case. It’s more that the operator doesn’t mind if these statistics are publicly accessible.

Whether or not bettors use this info as gospel is up to them, but the sports betting world certainly doesn’t discourage it.

Betting splits are broken down by point spread, total points, and moneyline, and then again by % handle and % bets. In this particular example, the numbers run pretty close together, with most of the money and tickets on the Philadelphia Eagles and the Over.

Expert Tip: Betting splits always add up to 100%, as they account for the sum of all money wagered and ticket written.

However, there are some discrepancies, particularly between the amount of money wagered (87%/13%) and bets taken (75%/25%) on the total. It looks like under bettors wrote a fair number of small tickets. Since the widespread belief is that casual bettors make smaller bets, this would signal that the “sharp money” is on the over.

In reality, that’s not necessarily the case, or at least not at the posted line of 44.5.

The NFL Consensus Explained

The NFL Consensus is just a fancy way of saying which team or bet the public is favoring. It usually applies to only point spreads or totals.

If 60% of the bets and 55% of the money are on the Detroit Lions -3.5 then this is a weak consensus. However, if 90% of the bets and 88% of the money comes in on Over 45.5 then this is a very strong consensus.

When the bet and money percentages are at odds with one another, it’s a split consensus.

Where To Find NFL Public Betting Statistics

These days, it’s extremely easy to find NFL public betting trends. As mentioned earlier, sportsbooks will often post this information in newsletters or on social media.

Sports media companies affiliated with sportsbooks, and there are a lot of them, will tabulate betting splits from multiple books and post them in a neatly formatted table. The information they receive is provided directly from the books.

There are also a plethora of apps that allow players to record and share their wagers, or even link to their sports betting accounts. The app will then aggregate all the data for a given game, and post the splits.

Finding accurate betting splits is no longer an issue, and as more states legalize online sports betting, the data will become even more precise. To read more about the legal status of sports betting in your state, check out BettingUSA’s state-by-state page.

Public Betting Splits And Money Percentages

Are public betting splits and money percentages useful NFL betting tools? Sadly, most information that’s made readily available to the public, is mostly useless as far as finding value is concerned.

Regardless, many bettors still heavily rely on public statistics to influence their NFL betting strategies, and this is largely because of the media narrative. Let it be clear, that bettors who already throw darts at the wall will never be worse off by following or fading the public over the long term.

It’s just that public betting is primarily noise that increases bettor engagement but shouldn’t be used as a primary betting tool, with few exceptions.

Don’t believe us? Here are four common public betting myths debunked:

Myth #1: Sportsbooks Move Lines In Response To Public Betting Trends

There’s a common belief among bettors, journalists, and even some sports betting analysts that sportsbooks consciously try to balance action on both sides of NFL wagers. Back in the early days of sports betting this claim had some merit, but it’s a bookmaking philosophy that’s mostly gone by the wayside.

Simply stated, sportsbooks no longer strive toward 50/50 betting splits. They care about posting good lines. There are two reasons behind this paradigm shift. One, algorithmic sports modeling and risk management protocols enable sportsbooks to shape efficient lines before incurring too much liability.

Perhaps more importantly, the sheer volume of available sports wagers means that sportsbooks aren’t slaves to one outcome. If 95% of the money is on the L.A. Rams -2.5 and they win on a last-second field goal, there are literally thousands of opportunities that very day for sportsbooks to recoup their losses.

With so many available betting markets, variance is balancing out more quickly than ever before. This means that in the long-run sportsbooks will collect exactly what they’re supposed to, via the vigorish levied on every bet.

Vegas might have a losing day, but they’ll never have a losing year. Neither will online sportsbooks, and even those losing days are becoming far less frequent. When it does happen, today’s sportsbooks are so well-funded that short-term losses are easily absorbed.

So what does all of this mean with regard to NFL public betting trends? It signals that sportsbooks do not move lines in response to public money, because singular outcomes are not important.

Even Super Bowl lines are rarely influenced by public betting trends. Considering that Las Vegas sportsbooks have profited on 30 of the past 32 Big Games, holding their ground was the smart play.

Exceptions To The Rule

There are exceptions to this hard and fast rule, but they’re rare. A good example is the Mayweather v. McGregor fight. McGregor opened at roughly +950 and casual bettors couldn’t get enough of the flamboyant underdog. The sportsbooks panicked and the line moved all the way to Mayweather -550 / McGregor +375.

The sharps pounded the Mayweather line, with several late $1 million bets coming in. Sure, the action evened out, but the books ended up offering bettors so much closing line value that they cost themselves tons of equity. That mistake probably won’t happen again.

In addition, some sportsbooks might shade a line when they expect a lot of action on one side. Since online sports betting is regulated on a state-by-state basis, this can happen when local teams are playing.

For instance, if the sharp line on the New York Giants is +3.5, New Jersey sportsbooks may see what happens at Giants +3. However, this practice is becoming obsolete.

Finally, heavy action on smaller or less efficient markets like some NCAA divisions, may cause sportsbooks to react. However, the NFL is anything but a small market.

Myth 2: Bettors Should Follow The Money

Some bettors blindly follow the public money, their logic being that sharps make large bets and casuals bet small.

This is not an accurate assessment. The regulated US sports betting industry is mostly comprised of what’s known as “recreational sportsbooks.” Sadly, these books are known to limit winning players. They usually won’t be banned, but it’ll be difficult for them to get significant money down on props, alternatives, and derivatives, and their limits often extend to main NFL markets like point spreads.

More likely, the money is coming from high-rolling casuals, often referred to as “whales.” Players can usually verify bits and pieces of this information on social media as influencers love to spout Tweets about how such-and-such bet $500k on an NFL spread or total.

That being said, it is possible that the money is being bet indirectly by sharps. To clarify, some sharps have their square friends or network connections bet for them. These “beards” haven’t been flagged by the sportsbook as sharp, so they’re able to wager a ton, at least for a little while.

So while there may be hints as to where the money is coming from, public betting data and social media anecdotes don’t paint a complete enough picture to base bets on money percentages.

Myth #3: Fading The Public Is A Profitable Strategy

Many a heated argument has broken out over whether fading the public, which simply means betting against the bet % consensus, is a viable strategy.

The answer is that it’s viable about as often as it’s not. The belief is that the public mostly loses money on the NFL so by going against them, bettors put themselves in a favorable spot.

In reality, the public doesn’t lose money because they’re wrong more than 50% of the time, it’s because they’re right 50% of the time, and get eaten up by vigorish.

To beat standard NFL point spreads, the public would have to be correct more than 52.4% of the time. On a weekly basis that’ll happen often enough, but over the course of many seasons, they’re going to be down approximately 4.55% of their total betting handle. So will the bettors that bet against them.

The same logic applies to betting underdogs against the spread. From 2013-2022, which is a relatively small sample size, underdogs went 1303-1206-62 ATS. That sounds really good, and it may illustrate that sportsbooks weigh favorites too heavily.

However, it’s still only a 51.9% win rate, which isn’t enough to beat the vig. Not to mention, if there are any holes in a sportsbook’s algorithm, they’re going to plug them up.

Myth #4: Reverse Line Movement Should Always Inform Bets

Reverse line movement can be a legitimate public betting signal, sometimes, but capitalizing upon it is difficult.

For those unfamiliar, reverse line movement is when the vast majority of bets come in on one side, but the line moves in the other direction. If the Minnesota Vikings open at -3 against the Packers, but drop to -2.5 despite attracting 80% of the betting handle, that’s an example of reserve line movement.

In many cases, this phenomenon occurs because a lot of small, sharp bets came in on the Packers. Therefore, bettors that now bet the Pack are on the sharp side.

Not exactly. Reverse line movement could be a response to other factors, such as player injuries or a star running back caught partying in the clubs. Always check if game conditions changed before jumping to conclusions.

Even if the reverse line movement was a result of sharp betting, it won’t necessarily help bettors that scour public betting reports. The reason for this is that sharps bet numbers, not sides. In the above example, the Packers +3 -110 could be a profitable wager, but at +2.5 it’s likely not. That half-point might be worth 20-25 cents since it crosses a key number.

Put simply, bettors that trail sharps at worse odds are not getting the best of it.

Focus On Line Shopping and Handicapping

Following public betting trends can be a fun pastime, and it’s always a hoot when the masses beat the sportsbook. However, bettors should not use them as a substitute for other handicapping methods.

Instead, a serious bettor’s time is much better spent focusing on line shopping, data modeling, and generating closing line value by betting before a line is hammered into efficiency.

Unfortunately, there are no shortcuts on the road to becoming a winning bettor. If public betting trends were a pathway to finding edges, the majority of bettors would already be rich.

Robert Dellafave is an expert sports bettor, professional gambler, and advocate for the fair treatment of sports bettors.