LineLibrary: The NASDAQ of Sports Betting?

Update from the editors: LineLibrary was changed to Vigtory, then sold to FuboTV, and is now closed. This post will remain live for a historical archive.

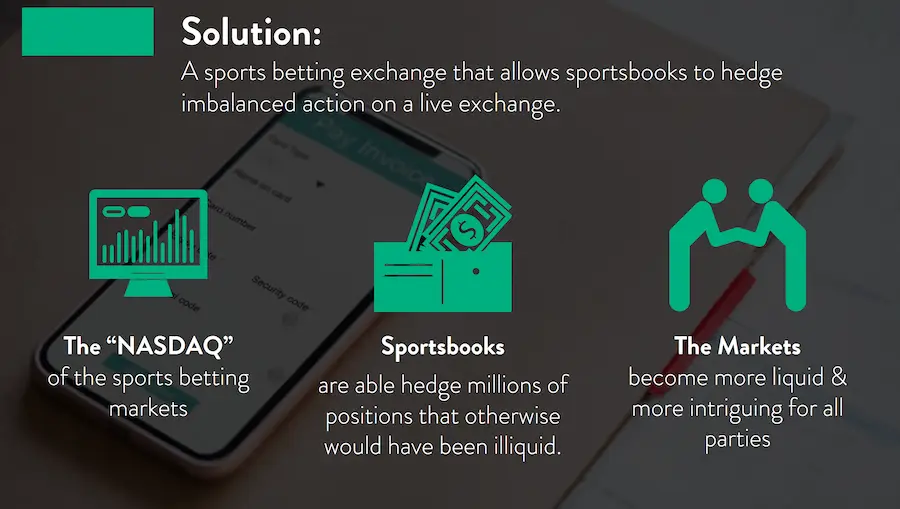

LineLibrary was a Chicago-based startup that had its sights set on completely changing the way sportsbooks do business. With a vision of “creating the NASDAQ of sports betting markets,” LineLibrary wanted to create the first independent betting exchange designed primarily for sports betting operators.

The idea behind the company was to create a marketplace that could show sportsbook operators a massive amount of line movement data in real-time and allow those operators to offset risk on a business-to-business (B2B) exchange. LineLibrary aimed to position itself to be able to handle the estimated $400 billion sports betting market, all on one platform.

A marketplace showing millions of different positions in real-time would have allowed sportsbook operators and other users to perform risk management at the highest level. What this meant to the books is that rather than needing to adjust their lines to manage liability, they would have a faster and more efficient way of accomplishing that with no line movement necessary – by essentially laying off wagers on the LineLibrary exchange.

Sportsbooks typically make their money on the margins. A book will charge 10-percent “juice” and with even action on both sides of a game they are guaranteed to make a profit. But enticing even action on both sides is a challenging endeavor.

In your average sportsbook, when the Patriots are taking 90+ percent of the money on a game at New England -3, the book will move the line up to -3.5 and then to -4 to encourage betting action on the other side. While the bookmakers may believe that the “true line” is -3, they will adjust the line to balance their liability.

According to LineLibray, “there is currently no efficient mechanism for hedging imbalanced action without shifting lines to entice wager creation.”

LineLibrary wanted to change that. By using its marketplace, anyone with a subscription could gain access to a new way to manage risk by hedging imbalanced action on the exchange.

The Origins of LineLibrary

LineLibrary was developed as a risk-management platform that claimed to have the capacity to track micro-transactions across the $400 billion sports betting industry.

Early on, LineLibrary received valuable industry-related press coverage by winning the ICE North America LaunchPad competition. ICE is a major gaming conference in Europe that, for the first time, held a North American version of the event in Boston in 2020.

The company was started by Chicago native Sam Rattner and included an engineering team uniquely equipped to create a financial-based product. LineLibrary’s Principal Engineer was a lead software architect for Betfair, which itself is the largest business-to-consumer (B2C) exchange betting provider in the world.

The team also included a lead developer who previously worked for Citigroup’s trading platform and a former energy commodities trader who built the backend risk management API for a new cryptocurrency.

The LineLibrary Product

The problem, as LineLibrary saw it, is that sportsbook operators were leaving vast amounts of money on the table as they balanced their action. By using an inefficient method of hedging imbalanced volumes of bets, there was a lot of money left on the table.

The solution: the LineLibrary marketplace.

How Did LineLibrary Work?

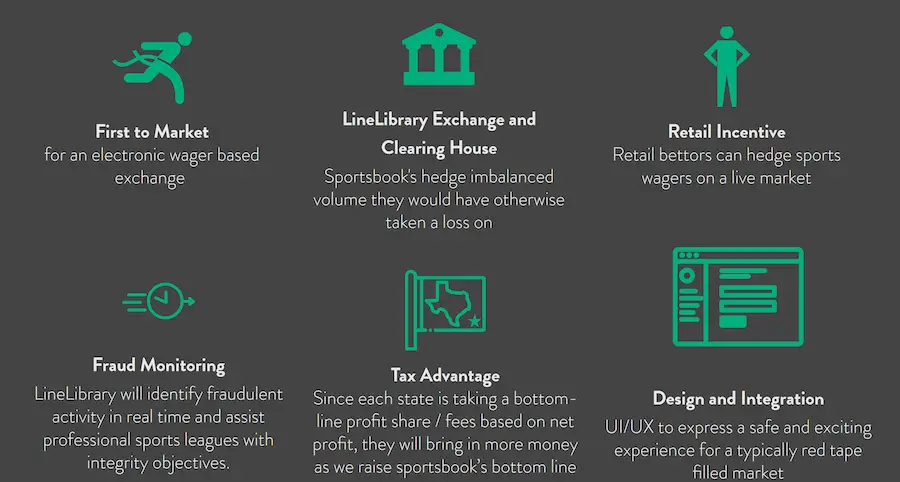

The primary goals of to the LineLibrary product were to eliminate latency (information delays) and provide an independent B2B exchange. With a low-latency product, LineLibrary aimed to have a network that could process an enormous amount of information and can handle quickly-changing datasets in real-time.

LineLibrary was not the first sports betting exchange to come along, but it was the first with a B2B focus rather than B2C. LineBrary did not intend to cater to everyday customers; it sought to serve sportsbook operators.

The exchange betting business model is nothing new, but LineLibrary was the first designed specifically for sportsbook operators. Smaller operators may lay off risk onto exchanges from time to time, but traditional exchanges are not purposely designed for that use-case.

Additionally, traditional betting exchanges serve their own customer bases first; their business model is completely B2C. LineLibrary, on the other hand, was designed specifically for sportsbooks around the world to manage risk on an independent exchange that was not subject to its own biases.

A slide from a LineLibrary slideshow compared sportsbook operators and betting exchanges to financial brokers and exchanges. In the financial world, B2B exchanges serve brokers and brokers serve customers. For example, you don’t see NASDAQ or the NYSE operating its own exchange:

LineLibrary founder Sam Rattner put it this way in an interview with EGR North America:

“Bookmakers operate straight to the consumer, like TD Ameritrade and Charles Schwab but they are not the NYSE. And the current exchanges all either have a sportsbook or are actively trading on their own exchanges.

“If TD Ameritrade launched their own exchange, would Charles Schwab send their client there? Because I don’t know if TD Ameritrade would execute others’ trades before their own clients’. The NYSE doesn’t have a brokerage for a reason. In theory, an exchange is built for the betterment of the market and it perceives no risk because it is not involved in the market. So, having independent infrastructure allows us to be more efficient. We don’t have the overhead to make sure we are hedging our positions or making sure we have liquidity from other retail users so we can charge much lower fees than those competitors.”

LineLibrary planned to monetize its service via three different methods:

- 1% Trading Fee

- Annual Sportsbook Fee

- Data Deals

A Promising Start

The startup raised $2.5 million in its first 18 months and won a prominent award early on, putting it in front of much wider audience and positioning LineLibrary for further growth.

However, harnessing the collective online sports betting market was am ambitious goal, and LineLibrary struggled to gain the traction it needed for longterm success.

Tania brings over 10 years of experience as a gambling industry reporter to BettingUSA.com, providing frequent news coverage and coverage of current events.