Exclusive Interview: Kambi Prepares For Life After DraftKings

One of the most significant non-COVID developments in 2020 is the unification of DraftKings and SBTech into a single company. The reverse merger saw the daily-fantasy-sports-turned-sports-betting-company go public with a multi-billion-dollar valuation.

One of the subplots of this story is the inevitable migration of the DraftKings sports betting platform from its current partner, Kambi, to SBTech. And by extension, what impact that will have on Kambi’s US operations.

To better understand the situation, Betting USA spoke with Max Meltzer, the chief commercial officer at Kambi.

The End of the Kambi-DraftKings Era

The Kambi-DraftKings marriage may have been short-lived, but it was extraordinarily successful. And unlike many breakups, the divorce looks to be amicable.

A recent press release announced Kambi and DraftKings “have reached an agreement to mutually support and cooperate on DraftKings’ planned migration from Kambi’s back-end platform services to the SBTech sports betting and iGaming platform.”

The press release also notes the planned termination date, September 30, 2021, and that DraftKings can leverage its proprietary technology (SBTech) prior to its decoupling from Kambi.

DraftKings will also “take additional steps during the transition period to safeguard Kambi intellectual property, ensuring a secure and efficient transition for both parties.”

“Kambi has been a collaborative partner and was instrumental in DraftKings being first to market in New Jersey with our sportsbook,” Paul Liberman, DraftKings President of Global Technology and Product said in the press release. “We appreciate the efforts they have made and will continue to make, in helping to ensure a smooth migration for us as we move on to our own platform.”

That’s the story from the DraftKings perspective. Meltzer shed some additional light on the migration from Kambi’s point of view:

“First of all, we’re very pleased to agree to the migration plan with DraftKings that secures revenues for us into the latter stages of next year. To be clear, it’s always beneficial to do migrations in a planned, phased, and professional manner.

“That is the kind of reputation we want to be known for. It’s professional, and it’s good business.”

Kambi’s Road to US Success

Few companies have had more success in the US sports betting market than Kambi. The sports betting supplier was virtually unknown in the US before 2018 but quickly rose to prominence. As Meltzer explains, a big part of Kambi’s US success traces back to its partnership with DraftKings.

“We’ve had a great partnership with DraftKings, and DraftKings is one of the major reasons we established our own reputation in the US,” said Meltzer. “As much as people look forward, it’s always good to look back and respect where we have come from, so to speak. DraftKings was a major player in helping us succeed and showcasing our product.”

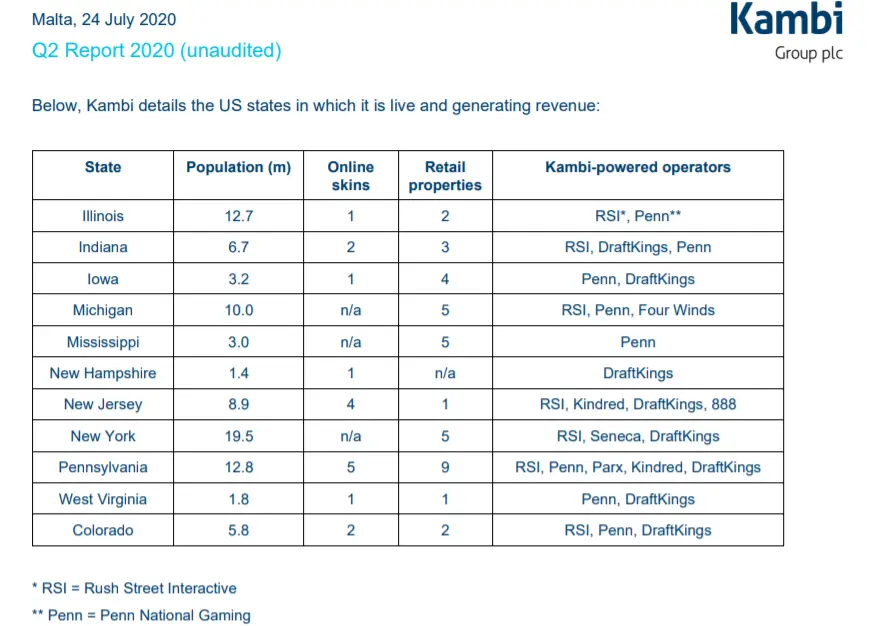

In addition to DraftKings, Kambi has partnered with some of the most prominent players in the legal US sports betting industry. These partnerships (seen in the graphic below taken from Kambi’s recently released Q2 report) have positioned the company in virtually every key US sports betting state.

Is Kambi Ready for its Post-DraftKings Existence?

Even with the loss of DraftKings, it’s easy to make a case that Kambi is still the best positioned B2B sports betting company in the US market. That is due in large part to its strong national and local partners, and the associated market access.

When asked about the company’s future sans DraftKings, Meltzer highlighted two of its high-profile partnerships, as well as its numerous local commercial and tribal partners.

“We’re very excited about the Barstool Sports launch planned for Q3. They’ve got a fantastic database, a very different database than others, and we think they’re developing interesting technology and hiring fantastic people. That’s going to be really exciting for Penn National.

“And we’re obviously delighted about Rush Street Interactive going public. They’re going to have a wealth of resources to acquire new customers, retain customers, and get market access.

“We also recently signed a deal with Four Winds in Michigan, adding another really strong tribal gaming operator following partnerships with Seneca and Mohegan Sun.

“Looking into the future, we expect to work with these multi-state and local market leaders. We’re doing very well now, but there’s plenty more to be done and a large number of markets to come.”

Changes for a COVID World

Meltzer also discussed the need to evolve in a world filled with so much uncertainty.

“The key message from all of this (the pandemic shutdowns and suspension of sports) is it’s really important to find a way of getting everything online,” Meltzer said. “It’s a way of backing things up and diversifying your financial risks.”

That’s something lawmakers, regulators, and operators are already realizing. Several states have fast-tracked rollouts or expanded into online distribution channels, and COVID has accelerated conversations in other states.

Another part of that diversification is hybrid technology like Kambi’s Bring Your Own Device solution. Bring Your Own Device allows bettors to view lines and construct bets on their mobile device, generating a QR code that they can then bring to a retail sports betting counter or even a kiosk and scan in their bets without touching any surfaces and minimizing interactions.

This tech is already available in more than a half-dozen states and has helped sports betting revenues rebound. “There aren’t many suppliers or operators out there offering anything equivalent to this,” Meltzer noted. “I think that demonstrates how strong our tech stack is – otherwise everyone would do it.”